Best Practices for Avoiding Illegal Trading

You are not required to stop trading in a company's stock just because you are employed there. Yet, there are precautions you should take to be sure you adhere to the law. Let's have a look at some recommendations for preventing unlawful insider trading.

Not all Trades made by an insider are Illegal

Contrary to popular belief, not all trades made by an insider are illegal. Just because you work for a publicly traded company does not mean you must refrain from trading its stock. There are, however, steps you should take to ensure you stay within the boundaries of the law. In this chapter, we will look at some best practices for avoiding illegal insider trading.

There are many steps that an organization can take to help prevent illegal insider trading.

Set up a 10b5-1 trading plan for key investors. If approved, this plan will allow them to trade a predetermined amount of company stock in predetermined intervals. Consider making regular trades of index funds instead of company stock. The key is to keep the trades consistent in both size and time between trades.

Set up blackout periods where employees cannot trade company stock during a time when MNPI may be widely prevalent. Allow for specific trading windows which allow insiders to trade company stock during a designated time period after MNPI has been released. An example of a trading window could be after quarterly earnings are released to the public or after government approval of a product has been publicly announced.

Have procedures in place for employees who have access to MNPI to pre-review all trades before making them. Depending on the size of the company, report insider transactions within two business days. Require all key-level owners, directors, and board members to disclose insider trades to a public database.

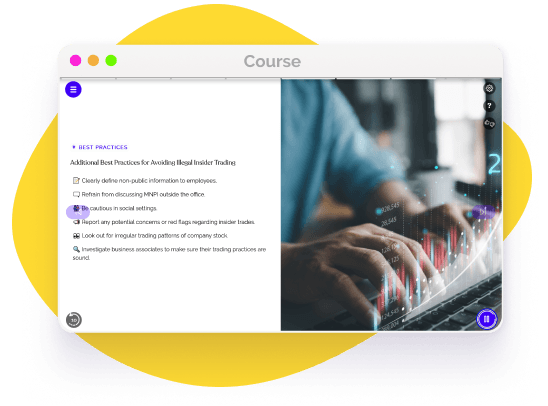

Additional Best Practices

The list of best practices necessary to avoid illegal insider trading is rather extensive. Here are some additional ways to stay in compliance with the law.

Here are some myths to look out for:

- -

Refrain from discussing MNPI outside the office.

- -

Clearly define non-public information to employees.

- -

Be cautious in social settings.

- -

Report any potential concerns or red flags regarding insider trades.

- -

Look out for irregular trading patterns of company stock and

- -

Investigate business associates to make sure their trading practices are sound.

Prevent illegal insider trading with EasyLlama Training

Everyone who engages in transactions in the public markets with the aim of preventing illegal insider trading can gain something from this training, regardless of whether they work for a publicly traded company. Employee engagement and information retention are enhanced by the interactive knowledge checks and real-world video situations used in this workplace training from EasyLlama.

Helping over 8,000 organizations create a safer, more productive workplace

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: