Best Practices for Detection and Prevention

Prevent money laundering using effective strategies. Explore best practices, assess risks, and establish strong controls to safeguard your organization and promote a safer financial environment.

High-Risk Jurisdictions & Financing

Transactions involving high-risk jurisdictions or countries with money laundering or terrorist financing histories require extra scrutiny. This includes countries identified as having weak anti-money laundering regulations or being uncooperative in international efforts to combat financial crimes. To mitigate the risks associated with these transactions, additional due diligence measures should be implemented, such as enhanced customer identification and transaction monitoring.

Identifying potential red flags of money laundering behavior is crucial in detecting and preventing illicit financial activities. By understanding these warning signs, financial institutions can enhance their due diligence processes and contribute to the global efforts in combating money laundering.

Watch for customers who insist on using unusual payment methods or those that are difficult to track, such as prepaid cards, cryptocurrencies, or money orders.

Keep an eye out for unexplained relationships between customers or third parties involved in a transaction. These relationships could be a sign of a complex money laundering scheme or a shell company being used to obscure the true ownership of the funds.

If a customer or transaction involves an unusual source of wealth, such as unexplained inheritances, large gambling winnings, or sudden spikes in income, it may be a sign of money laundering.

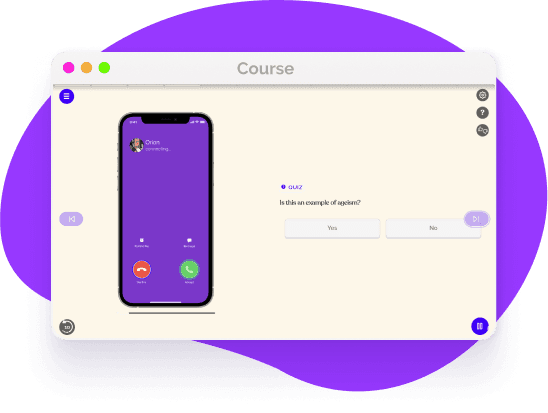

Effective Customer and Transaction Reviews

Thoroughly review customers and transactions for accurate documentation and detect irregularities like forged signatures or incomplete identification. Comprehensive reviews mitigate fraud risks, ensure regulatory compliance, and maintain operational integrity.

High-Risk Jurisdictions

Certain countries are considered high-risk jurisdictions due to weak anti-money laundering regulations or a history of financial crimes. Please note that this list is not exhaustive and can evolve over time.

Here are some myths to look out for:

- -

Afghanistan

- -

Iran

- -

North Korea

- -

Iraq

- -

Syria

- -

Yemen

- -

Somalia

- -

Venezuela

- -

Pakistan

- -

Libya

Help Detect and prevent money laundering through employee education

Employee education is crucial in detecting and preventing money laundering. Comprehensive training programs enable employees to recognize risks, red flags, and compliance procedures, fostering a culture of compliance within the organization.

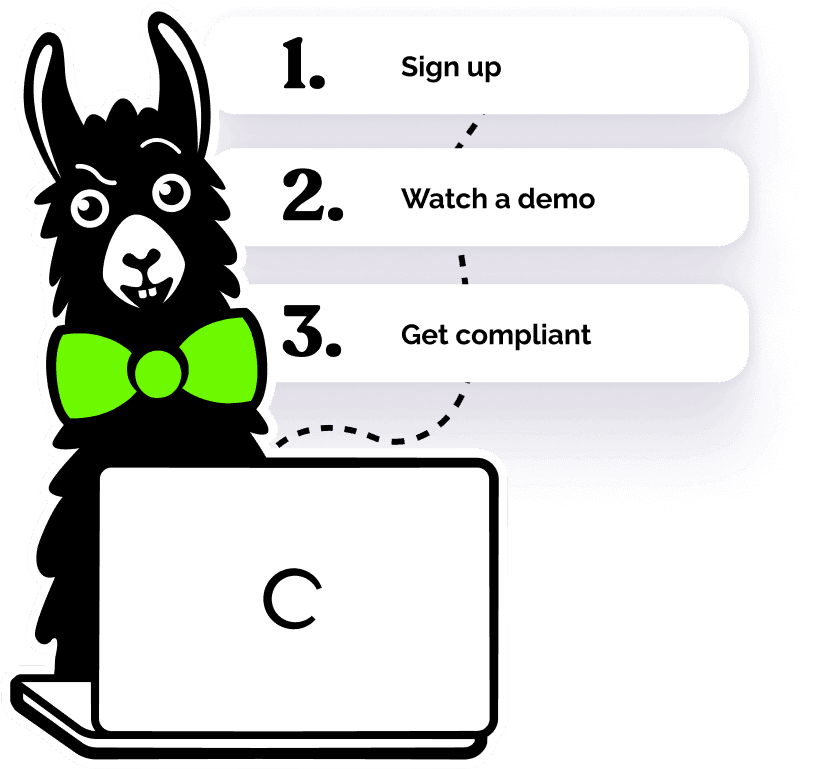

Helping over 8,000+ organizations create a safer, more inclusive company culture

Uncover the intricate world of anti-money laundering through our comprehensive course, delving into laws, criminal techniques, and effective prevention measures for enhanced financial security. This course covers: