Conclusion to PCI DSS Training

We have covered essential topics related to the security of payment card data and compliance with the PCI DSS standards. Now, let's summarize the key points and takeaways from our journey.

Key Requirements of PCI DSS

We explored the twelve high-level requirements of the PCI DSS, which include maintaining a secure network, protecting cardholder data, implementing strong access controls, regularly monitoring and testing networks, and maintaining an information security policy. Each requirement is vital for ensuring the security of payment card data.

Let’s debunk some prevalent misconceptions surrounding PCI DSS (Payment Card Industry Data Security Standard). Understanding the truth behind these myths is crucial for businesses to approach PCI DSS compliance with clarity and confidence.

PCI DSS compliance is not a one-time event; it is an ongoing process. Achieving compliance once does not guarantee perpetual compliance. The security landscape is constantly evolving, and new threats and vulnerabilities emerge regularly. To maintain compliance, organizations must continuously assess and update their security measures, conduct regular security testing, and stay informed about the latest PCI DSS updates and best practices. Compliance is an ongoing commitment to ensuring the security of cardholder data and protecting against potential data breaches.

Some businesses believe that by using a payment gateway or a third-party service provider that claims to be PCI-compliant, they are automatically PCI DSS compliant themselves. However, this is a misunderstanding. While using a PCI-compliant payment gateway can help secure payment card data during the transaction process, it does not absolve the business from its own PCI DSS responsibilities. The overall compliance status depends on how the business handles and stores cardholder data and whether it meets all the relevant PCI DSS requirements.

One common misconception is that PCI DSS compliance is only relevant for large enterprises or organizations that process a high volume of payment card transactions. In reality, PCI DSS applies to any organization, regardless of its size, that handles payment card data. Whether you process a few transactions per month or thousands, if you accept credit or debit cards as a form of payment, you must comply with PCI DSS requirements.

Key Takeaways from PCI DSS Training

As we conclude this training, let's recap the essential points covered throughout the chapters.

Here are some myths to look out for:

- -

PCI DSS is a set of security standards designed to protect cardholder data during payment card transactions.

- -

Compliance with PCI DSS is essential for businesses handling payment card information to avoid penalties and reputational damage.

- -

The twelve requirements of PCI DSS cover various aspects of data security, access control, and network protection.

- -

Best practices for PCI DSS compliance include regular updates, encryption, access control, monitoring, and security awareness training.

- -

PCI DSS training is crucial to ensure all employees are aware of their responsibilities and contribute to maintaining a secure environment.

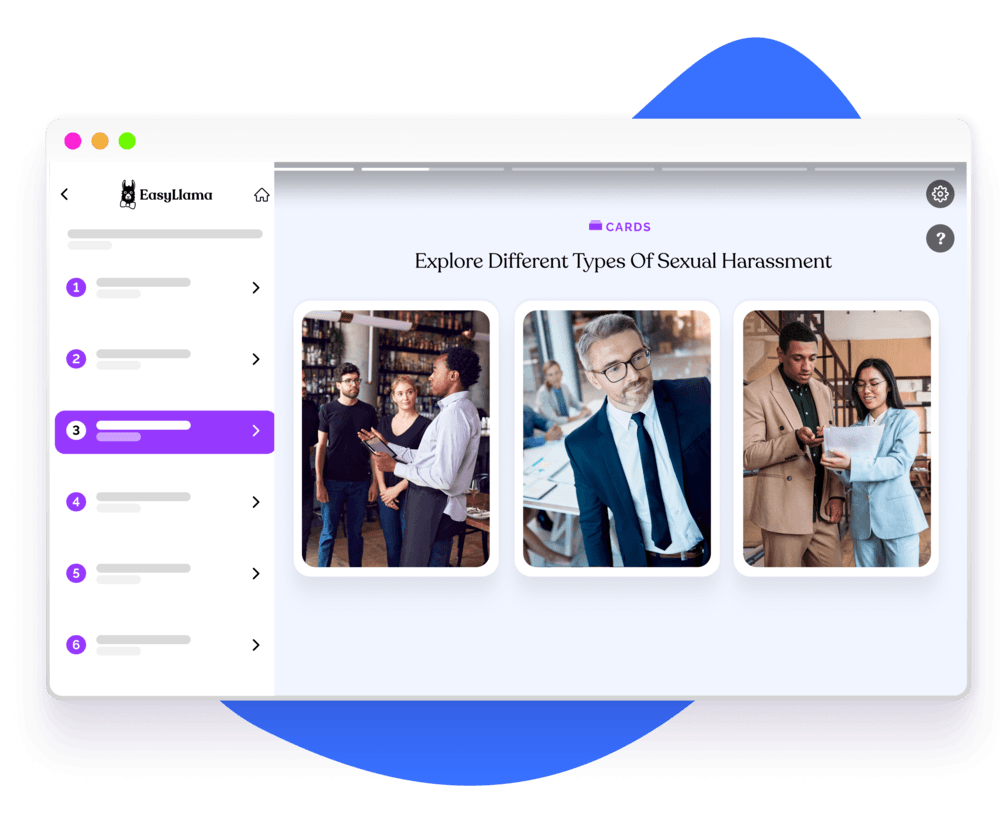

The most Robust PCI DSS Training Available

Our PCI DSS training sets the standard for excellence in educating organizations about payment card data security. Designed by industry experts, our course offers the most robust and comprehensive training available to help businesses achieve and maintain PCI DSS compliance. We cover the intricacies of the PCI DSS requirements, equip employees with practical insights, and provide real-world examples to ensure a deep understanding of data protection principles.

Helping over 8,000+ organizations create a safer, more inclusive company culture

The goal of this training is to educate employers and employees on their rights and responsibilities when it comes to PCI DSS in the workplace. This course covers: