Enforcement and penalties of the FLSA

The FLSA establishes the enforcement and penalties for violations of the law. Explore the various enforcement mechanisms and penalties that may be imposed for non-compliance with the FLSA.

Enforcing FLSA Regulations

The Wage and Hour Division enforces the regulations defined in FLSA with investigators located throughout the United States. These investigators gather data on various aspects of the law, including wages, hours, and other employment conditions or practices.

Penalties for not following the FLSA can be serious, ranging from paying back wages and liquidated damages to criminal prosecution. Take a look at some FLSA penalties to help employers understand the potential consequences of not complying with the law.

Liquidated damages are compensation an employee may be entitled to when an employer is found to be in violation of the FLSA. Under the FLSA, the employer is liable for the employee’s unpaid wages, plus an additional amount equal to the unpaid wages, known as liquidated damages.

Employers found to be in violation of the FLSA may be required to pay their employees back wages for any unpaid wages or overtime due to them. Under the FLSA, employers must pay their employees at least the minimum wage for all hours worked and overtime pay at 1.5 times the regular rate for all hours worked over 40 in a workweek.

Civil money penalties are one of the most common penalties for violating the Fair Labor Standards Act (FLSA). The U.S. Department of Labor (DOL) is authorized to assess civil money penalties of up to $1,100 for each separate violation of the FLSA.

Penalties For Non-Compliance

Understanding the potential penalties for non-compliance is essential for businesses, organizations, and individuals to ensure compliance with the law.

Here are some myths to look out for:

- -

Willful violators fined up to $10,000 and possible imprisonment

- -

Child labor violators fined up to $10,000 per violated employee

- -

Willful violations of minimum wage or overtime pay are subject to a $2,203 penalty per violation

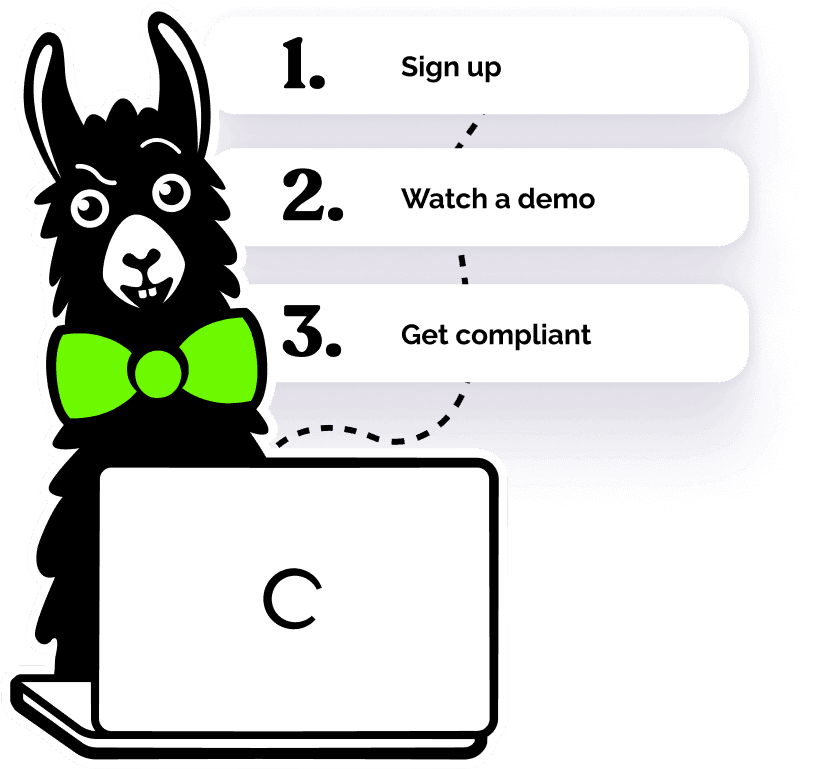

Protect your organization from hefty fines with wage and hour training

Wage and hour laws are complex and can vary widely from state to state, so ensuring that all employees are aware of the laws and regulations can help protect the organization from costly penalties. Through training, employers can ensure that employees are up to date on state and federal laws, as well as other rules and regulations, and can provide guidance on how to properly track and record hours, pay overtime, and ensure that all employees are fairly compensated.

Helping over 8,000+ organizations create a safer, more inclusive company culture

EasyLlama’s online training course guides employers to understanding the rights employees have in the workplace. There are many wage and hour laws, and each one is designed to provide employees with safeguards from a potentially hostile work environment. The course covers: