Fair Labor and Standards Act (FLSA)

Explore the Fair Labor and Standards Act’s purpose, key features, and how it applies to employers. See how FLSA impacts wage and hour laws, including wage and hour requirements, overtime pay, and record-keeping requirements.

Exempt vs. Nonexempt

Exempt vs nonexempt employees are classified based on their job duties and the wage and hour regulations set forth by the Fair Labor Standards Act (FLSA). Exempt employees are those who are not covered by the FLSA and are not eligible for overtime pay, while nonexempt employees are covered by the FLSA and are eligible for overtime pay. Exempt employees are usually salaried, meaning they are paid a fixed amount for the work they do regardless of the number of hours worked. Nonexempt employees, on the other hand, are usually paid an hourly wage and are eligible for overtime pay when they work more than 40 hours in a week.

There are federal, state, and municipal laws setting minimum wages. Employees in those locations must be paid the highest minimum wage regulated. If not, this could be considered wage theft.

Employers are not allowed to deduct wages from an employee's paycheck for any reason unless the employee has authorized the deduction in writing.

Requiring employees to work off the clock is a strategy sometimes used to avoid paying employees overtime wages, but even if the employee wouldn't be earning overtime hours, requiring workers to work off the clock is still wage theft.

There are federal, state, and municipal laws for setting minimum wages. Employees in those locations must be paid the highest minimum wage regulated. If not, this could be considered wage theft.

Paid and Non-Paid Breaks

Nonexempt employees must be given regular breaks and paid for breaks under 20 minutes. If a nonexempt employee works during a break, they should track that time so that they can be properly compensated. Breaks over 30 minutes, such as meal breaks, do not have to be paid, but employees must be relieved from all work duties while on break. Exempt employees are given breaks at their employers' discretion.

Myths about FLSA

Despite its importance, there are several myths about the FLSA that persist in the workplace. Here are some of the most common myths related to the FLSA, including misconceptions about overtime pay, independent contractors, and wage requirements.

Here are some myths to look out for:

- -

Employers can pay tipped employees below the minimum wage.

- -

An employer does not have to pay for work done on holidays.

- -

Salaried employees are not entitled to overtime pay.

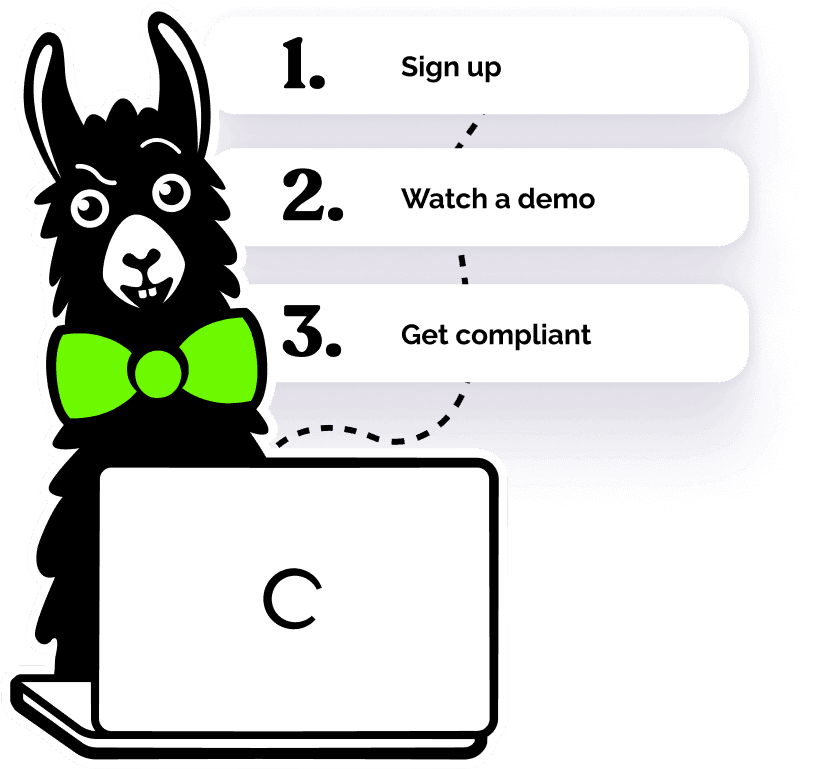

Protect Employee rights with wage and hour training

Protecting employee rights with wage and hour training is an important step for employers to take in order to ensure that their employees are treated fairly and receive the wages and benefits they are entitled to. Training can help employers understand the laws and regulations regarding wages and hours, as well as the rights of their employees.

Helping over 8,000+ organizations create a safer, more inclusive company culture

EasyLlama’s online training course guides employers to understanding the rights employees have in the workplace. There are many wage and hour laws, and each one is designed to provide employees with safeguards from a potentially hostile work environment. The course covers: