Staying in Compliance with the Foreign Corrupt Practices Act

The FCPA is a U.S. federal law that was enacted in 1977 to prevent American companies from using bribes or other inappropriate payments to win the business of foreign public officials or public organizations.

Two Provisions of the FCPA

The FCPA’s anti-bribery provision forbids any payment, offer, promise, or authorization to pay anything of value to any foreign official, foreign politician, or foreign political party with the intention to influence business. The accounting provision of the FCPA includes provisions for books and records and internal controls. The books and records provision requires companies to keep an accurate representation of financial transactions. The internal controls provision requires companies to create and maintain an accounting control system.

What is the FCPA?

During the early 1970s, there was an ongoing and widespread issue of U.S. companies bribing employees or agents of foreign governments and officials. As a result, the U.S. federal government put into law the Foreign Corrupt Practices Act (FCPA) making bribery of foreign officials illegal for U.S. citizens and entities. FCPA was enacted not only to help remedy the rampant bribery problem, but also to create equal opportunity for American businesses by leveling the playing field. The FCPA was designed to help end corruption in the United States and abroad and restore confidence and integrity in U.S. businesses.

Let's talk about the difference between bribes and what are called facilitation payments, as they relate to the FCPA.

On the other hand, bribes are transactions that can influence the outcome or final decision of a process—which is illegal under the FCPA. Bribes do not have to be financial in nature, as long as the person receiving the bribe is gaining something in exchange for their help.

Unlike a bribe, grease payments are paid directly to a low-level clerk or official and only influence the processing speed of a procedure, not its outcome.

Facilitation payments (aka "grease payments") are legal under the FCPA. A facilitation payment is a payment made to an official or individual to expedite a process (e.g., getting paperwork or an application reviewed faster).

Enforcement of the FCPA

The Federal Corruption Practices Act has an extraterritorial jurisdictional reach. This means that FCPA provisions can extend outside of the United States. The FCPA is enforced by the U.S. Department of Justice (DOJ) in cooperation with the Securities and Exchange Commission (SEC) through both criminal and civil action. For anti-bribery violations, corporations can be fined up to $2 million dollars per offense and individuals can face fines up to $250,000, plus imprisonment.

Concealed Bribe Examples

The accounting provision of the FCPA requires companies to keep an accurate representation of financial transactions. According to the Criminal Division of the U.S. Department of Justice and the Enforcement Division of the U.S. Securities and Exchange Commission, the following is a list of bribes that have been mischaracterized (aka concealed) under the guise of legitimate payments:

Here are some myths to look out for:

- -

Commissions or Royalties

- -

Consulting Fees

- -

Sales and Marketing Expenses

- -

Scientific Incentives or Studies

- -

Travel and Entertainment Expenses

- -

Rebates or Discounts

- -

After Sales Service Fees

Addressing the FCPA with anti-bribery workplace training

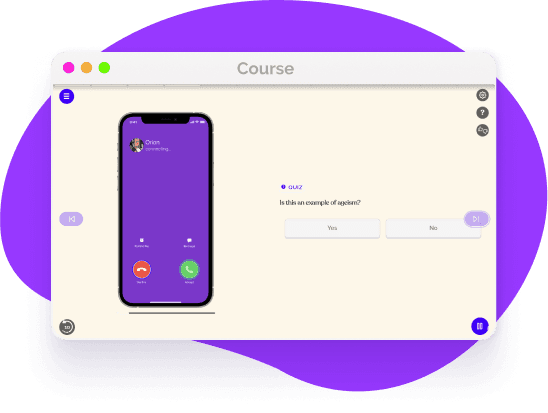

It is vital for employees to stay in compliance with the FCPA in your workplace. The best way to educate them on the legal details of the FCPA is with workplace training by EasyLlama. When it comes to preventing in the workplace and beyond, our interactive knowledge checks and and Hollywood-produced videos featuring real-life scenarios will help your employees better understand how to prevent bribery.

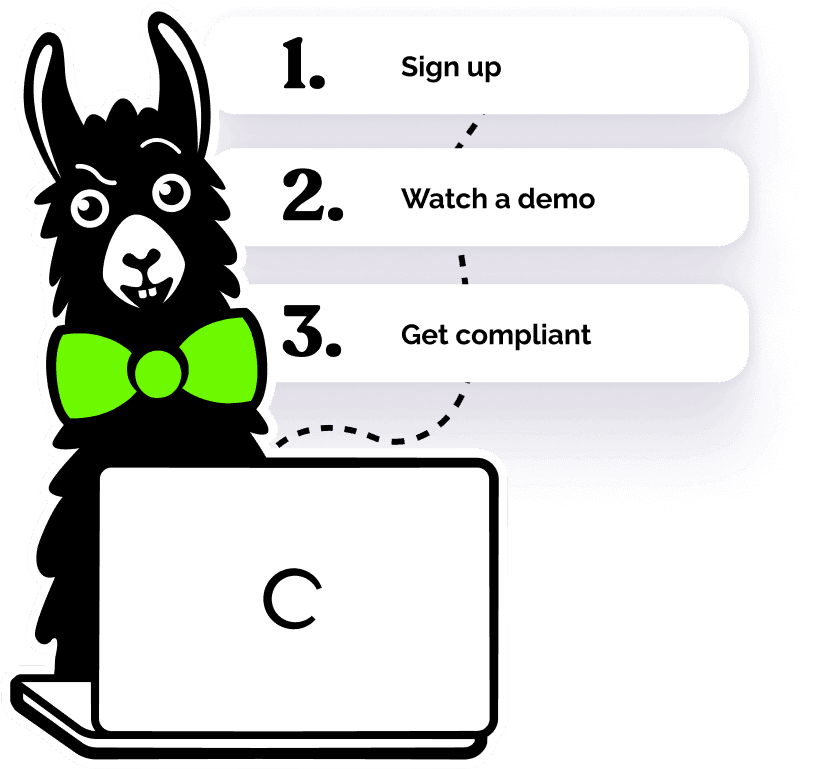

Helping over 8,000+ organizations create a safer, more inclusive company culture

EasyLlama’s online training course guides learners understanding FCPA and other anti-bribery legislation. Organizations should prioritize minimizing corruption risks by implementing a comprehensive anti-corruption course. The course covers: