Insider Trading Enforcement and Penalties

The Securities and Exchange Commission takes illegal insider trading very seriously, and views its enforcement as one of the major ways to keep public markets free from manipulation. Because the SEC wishes to ensure faith and trust in public markets, the penalties for illegal insider trading can be very steep. Let's take a look.

What are the maximum penalties for insider trading?

The SEC imposes a variety of fines and penalties for making illegal insider trades based on MNPI. The maximum criminal fine for individuals is $5,000,000. The maximum fine for a business entity whose securities are publicly traded is $25,000,000. The maximum prison sentence for an insider trading violation is 20 years. Both fines and imprisonment are possible punishments from the SEC for making an illegal insider trade.

The SEC Prosecutes Cases of All sizes

If fraud occurs in relation to insider trading, additional prosecution may occur resulting in greater fines or longer periods of imprisonment. The size or amount of money made in an illegal trade does not matter, the SEC prosecutes cases of all sizes. FINRA and the SEC use very sophisticated data analytics technologies that can detect even the smallest trades.

The SEC also gets help from other organizations. Let learn more about the SEC and the organizations that help enforce insider trading legislation.

The United States Department of Justice and regional U.S. Attorney's offices are in charge of prosecuting criminal insider trading cases. When individuals or organizations violate federal securities laws, FINRA and the SEC assist the Department of Justice in building the case for prosecution.

The Financial Industry Regulatory Authority, or FINRA, is a non-profit organization that handles licensing and oversight for the hundreds of thousands of stock brokers and thousands of securities firms in the United States. While FINRA is not part of the government, they do partner with the SEC to help detect illegal insider trading.

The SEC (Securities and Exchange Commission) is an independent federal agency responsible for regulating the trading of securities in the United States. The SEC was established by the Securities Exchange Act of 1934 to protect investors, maintain fair and orderly markets, and facilitate capital formation. The SEC prosecutes nearly 50 insider cases per year.

Government Agency Roles

What are the purposes of each government agency when prosecuting insider trading cases?

Here are some myths to look out for:

- -

Securities and Exchange Commission: Ensures integrity in public markets

- -

Financial Industry Regulatory Authority: Handles licensing for brokers

- -

U.S. Department of Justice: Prosecutes criminal activity

Educate employees about the consequences of insider trading

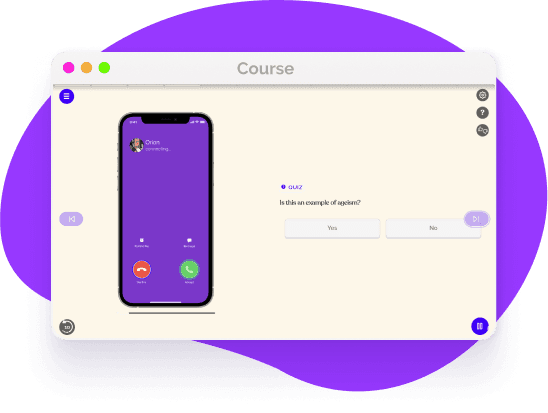

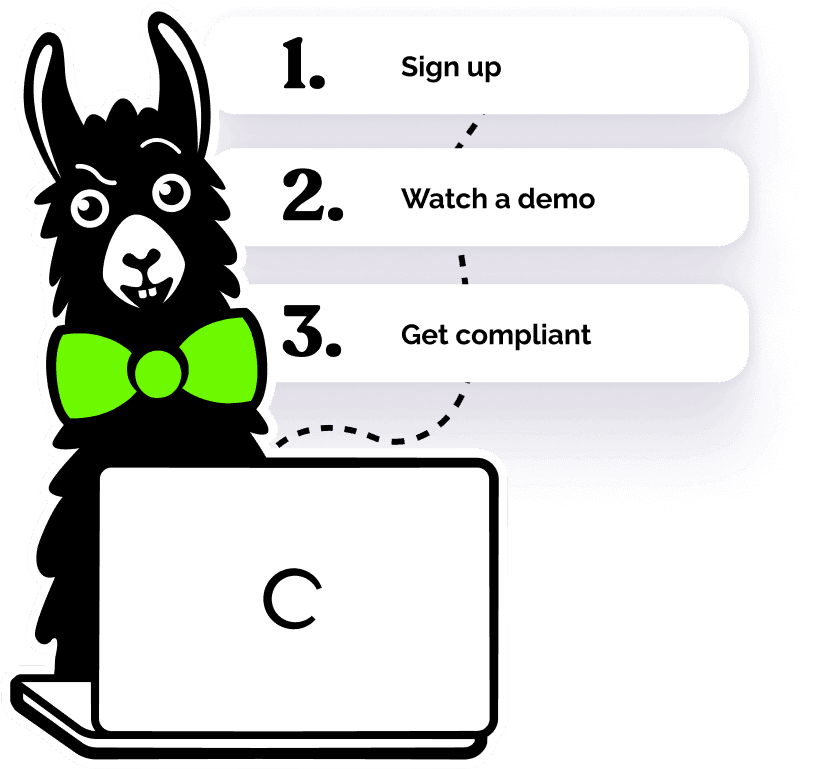

The SEC works to educate the public about the dangers of insider trading and the importance of maintaining honest and transparent markets, in part to deter others from engaging in it. EasyLlama’s workplace training on Insider Trading uses interactive quizzes and real-life scenarios to educate employees about the consequences and penalties for being involved in insider trading.

Helping over 8,000+ organizations create a safer, more inclusive company culture

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: