Introduction to Anti-Money Laundering Training

Explore the essentials of Anti-Money Laundering (AML) in our comprehensive training course. Learn key principles, regulations, and best practices to detect and prevent financial crimes effectively.

Money Laundering Is a Problem

Money laundering is a serious crime with devastating consequences for individuals, communities, and businesses. It enables criminal organizations to finance illegal activities, including drug trafficking and terrorism. It also facilitates human trafficking and smuggling. Legitimate businesses and financial institutions are also adversely affected, facing reputational damage and potential closure. By understanding and addressing the impact of money laundering, we can work toward a safer world for all.

Money laundering key terms provide a foundation for understanding the practice of disguising the origin of funds. These terms are crucial for comprehending the techniques, processes, and regulations related to combating money laundering.

A shell company in money laundering is a business entity created to hide the true ownership of funds. It lacks substantial operations and serves as a front for illicit activities. Criminals utilize shell companies to obscure the origin of money, making it challenging for authorities to trace and identify those involved. The use of shell companies highlights the need for stricter regulations and thorough investigations to combat money laundering.

In money laundering, "wash" refers to the process of disguising illicit funds to make them appear legitimate. Criminals aim to integrate the tainted money into the legal financial system, making it harder to trace and seize. The term emphasizes the deceptive nature of money laundering practices and the need for strong measures to combat this illicit activity.

Dirty money refers to funds obtained illegally and then laundered to appear legitimate. Money laundering involves complex transactions that hide the money's true origin. Criminals use these techniques to integrate illicit funds into the legitimate financial system, perpetuating their illegal activities. Combating money laundering is crucial for preserving the integrity of financial systems and preventing the growth of criminal enterprises.

The Global Scale of Money Laundering

The United Nations Office on Drugs and Crime estimates that $800 billion to $2 trillion of dirty money is laundered annually through the global economy. This immense scale emphasizes the urgent need for enhanced international cooperation and stronger anti-money laundering measures to effectively combat this widespread problem.

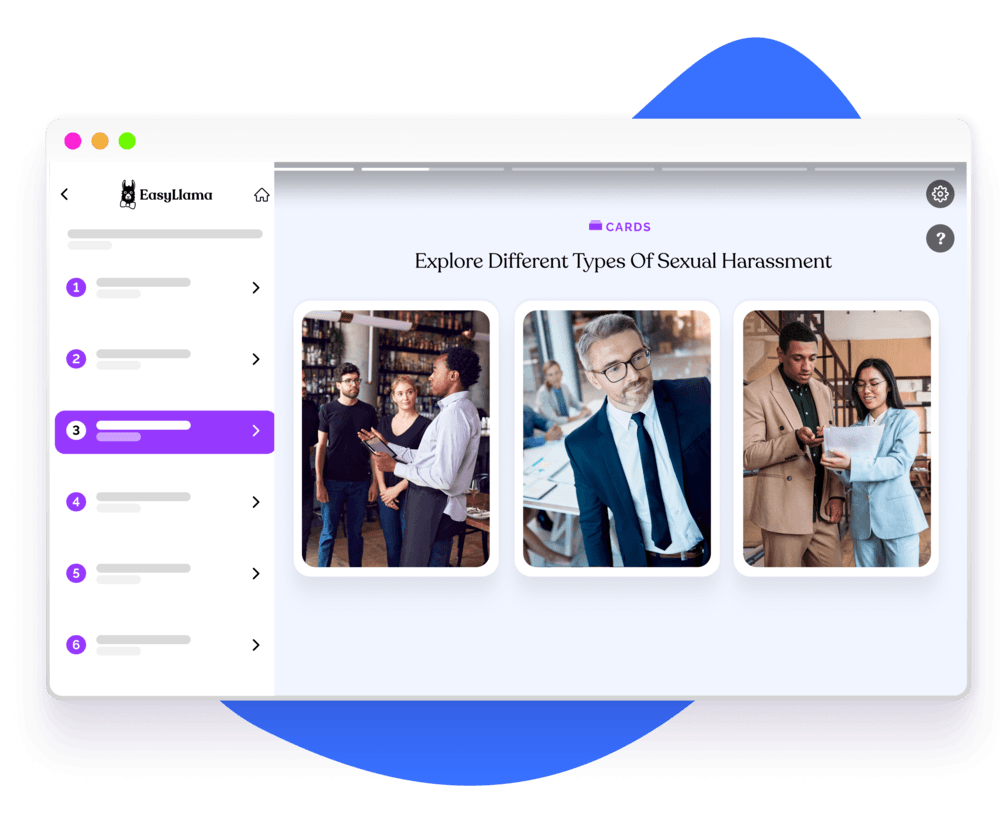

What is included in Anti-Money Laundering Training?

EasyLlama’s Anti-Money Laundering course focuses on practical applications for identifying and reporting suspected money laundering activities. The course covers:

Here are some myths to look out for:

- -

The proper definition of money laundering

- -

The laws that govern money laundering in the U.S. and around the world

- -

The legal ramifications and penalties for money laundering crimes

- -

How to identify techniques criminals use to launder money

The Most Comprehensive Online Anti-Money Laundering Training

EasyLlama's Anti-Money Laundering course provides comprehensive training to help employees recognize, respond to, and prevent money laundering activities in the workplace. Participants will learn to identify red flags, respond appropriately, and maintain compliance to combat financial crime effectively.

Helping over 8,000+ organizations create a safer, more inclusive company culture

Uncover the intricate world of anti-money laundering through our comprehensive course, delving into laws, criminal techniques, and effective prevention measures for enhanced financial security. This course covers: