Laws Governing Money Laundering

Uncover the laws governing money laundering, learn key regulations and prevention strategies to ensure a transparent and secure financial system.

Penalties for Money Laundering Offenses

Those found guilty of money laundering can face severe penalties under the law. Sentencing can range from 10 to 20 years of imprisonment, depending on the jurisdiction and the specific circumstances of the case. Additionally, hefty fines can be imposed, reaching up to $500,000 or twice the value of the laundered funds involved in the crime, whichever amount is greater.

Money laundering key terms provide a foundation for understanding the practice of disguising the origin of funds. These terms are crucial for comprehending the techniques, processes, and regulations related to combating money laundering.

The federal agency responsible for regulating and enforcing laws related to securities and investments, including anti-money laundering regulations for broker-dealers and investment advisers.

A part of the U.S. Department of the Treasury responsible for enforcing economic sanctions against countries and individuals that pose a national security threat.

A bureau of the U.S. Department of the Treasury responsible for administering and enforcing the Bank Secrecy Act and other anti-money laundering laws.

Money Laundering Illicit Activities

Money laundering has been known to fund money for illicit enterprises such as:

Here are some myths to look out for:

- -

Drug trafficking

- -

Human Trafficking

- -

Corruption

- -

Terrorism

Understand the laws governing Money Laundering through employee education

Employee education on money laundering laws is essential for organizations to combat financial crime effectively. By providing comprehensive training, employees gain the knowledge and awareness needed to recognize red flags, meet reporting obligations, and ensure compliance with anti-money laundering regulations.

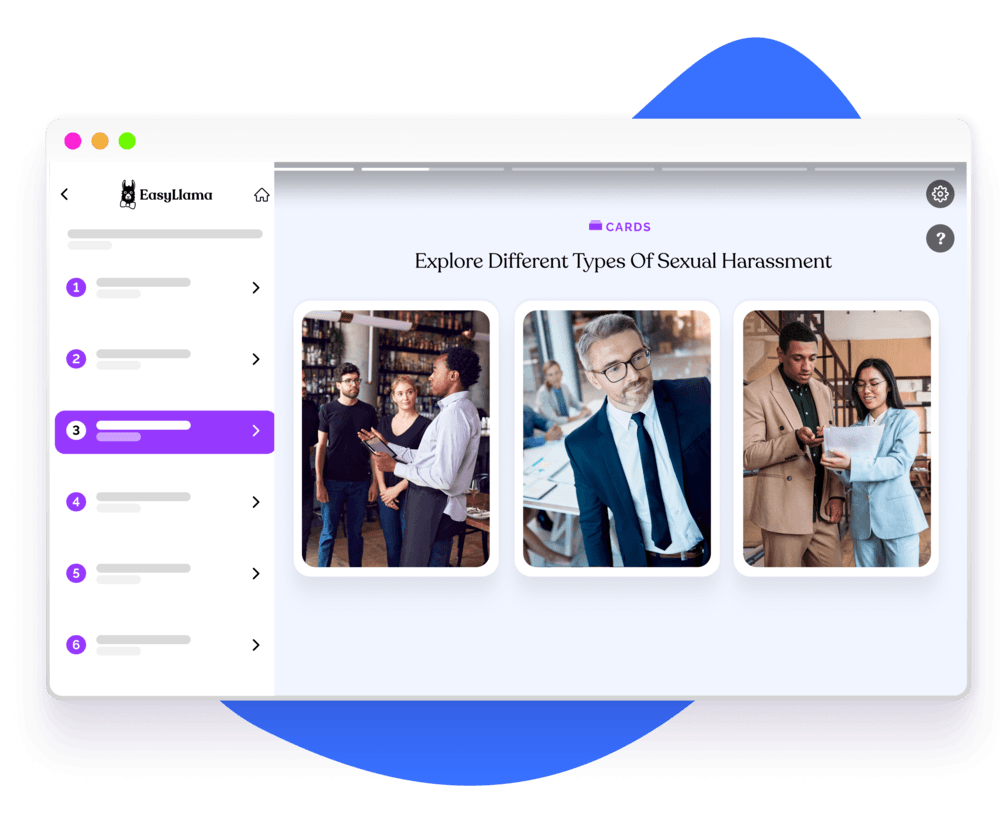

Helping over 8,000+ organizations create a safer, more inclusive company culture

Uncover the intricate world of anti-money laundering through our comprehensive course, delving into laws, criminal techniques, and effective prevention measures for enhanced financial security. This course covers: