Learning about Material Non-public Information

In this chapter, we'll take a look at material, non-public information and how it relates to insider trading. Understanding the difference between public and non-public information is vital to determining whether or not illegal insider trading has occurred.

What makes information illegal?

Making trades based on non-public information gives the person making the trade an unfair advantage over the general public. Making trades based on non-public information is considered illegal insider trading. Here's a not-so fun financial fact. It has been estimated that illegal insider trading occurs in 20% of all merger and acquisitions events.

What is Material Nonpublic Information?

Material Non-Public Information (MNPI) is any information or data that can affect the stock price of a publicly traded company and has yet to be released to the public, through either a report from the company itself or from the media. Public information is already available to the general public in one form or another, whereas nonpublic information is considered insider information.

Material information is information or data that an investor could reasonably consider important enough to influence their decision to buy or sell a security. Material information includes but is not limited to:

Changes in stock dividend: This is when a company changes the amount of money it pays out in dividends to shareholders. Investors use this information to determine if the company is paying out a reasonable amount of money in dividends and if the company is in a financial position to do so.

These are proposals in which two companies agree to combine their operations and/or assets, or one company agrees to purchase another company’s assets. Investors use this information to assess the potential returns of the deal and the impact it could have on the value of their investments.

These are reports released by a company, typically on a quarterly basis, that provide information on the company’s financial performance. This includes information such as the company’s sales, profits, and expenses. Investors use this information to assess the company’s financial health and determine whether it is a good investment.

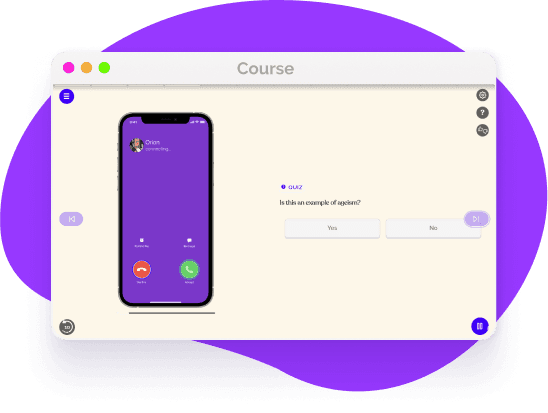

Can you identify MNPI?

In order to make sure you understand the SEC's regulations, let's review what is consider to be material information about a company:

Here are some myths to look out for:

- -

Sales or earnings reports

- -

Merger and acquisitions proposals

- -

Changes in stock dividend

- -

Potential litigation

- -

Changes in upper management

- -

Potential bankruptcy

- -

Government action or approvals

- -

New product development or new discoveries

- -

Significant contract changes

Learn about MNPI with EasyLlama’s Course on Insider Trading

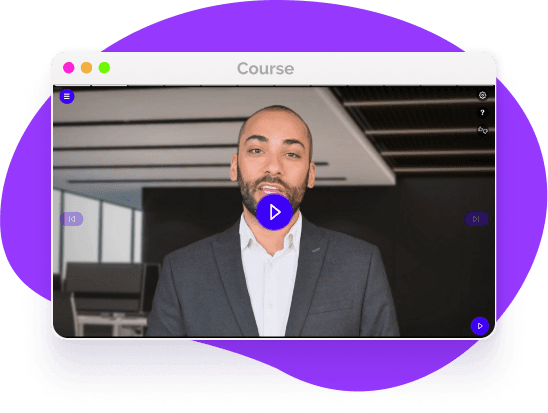

Everyone who engages in transactions in the public markets with the aim of preventing unintentional or intentional illegal insider trading can gain something from this training, regardless of whether they work for a publicly traded company. Employee engagement and information retention are enhanced by the interactive knowledge checks and real-world video situations used in EasyLlama's course on insider trading in the workplace.

Helping over 8,000+ organizations create a safer, more inclusive company culture

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: