Tippers and Tippees

According to the misappropriation theory, someone who receives a stock tip based on MNPI is also considered to be held to the same standards as someone who works for the company. Let's look more closely at stock tips and the difference between a tipper and a tippee.

Both Tippers and Tippees are Liable

Not every person who is guilty of illegal insider trading works for the company in question. According to the SEC, when a trade is made based on MNPI, both the tipper and tippee can be held legally liable and face potential consequences.

Tipping Is Illegal, even if the tippee doesn’t make a trade on it

Anyone who has access to MNPI must keep it confidential. Passing on confidential information to another person is illegal. Even if the tippee doesn't make a trade based on the information in question, passing along MNPI is an illegal act in itself and can be prosecuted by the SEC.

Anyone who has access to MNPI, and gives another individual a stock tip based on that information, is potentially committing a crime. Let’s talk about these types of individuals.

Tipper/tippee liability is enforceable even if the two parties do not know each other closely. It is always best to keep MNPI private, regardless of the situation.

A tippee is the person who receives a tip based on MNPI and makes an illicit trade based on the information received.

A tipper is someone who has access to MNPI and provides that information to an outside source who uses it to make an illicit trade.

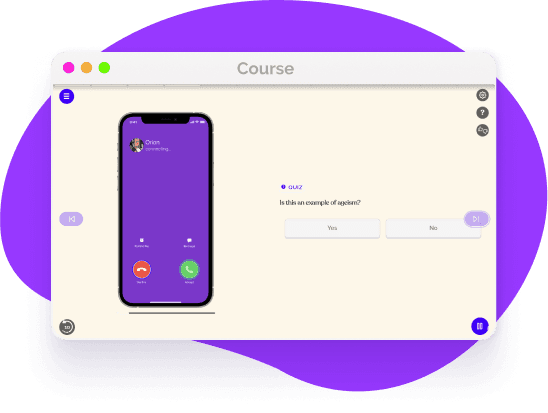

What about Social Media Tips?

Receiving stock tips on social media is just fine as long as the tips are not based on MNPI.

Here are some myths to look out for:

- -

Do your due diligence and research

- -

Make sure the information is publicly available before trading

- -

This liability can include stock tips from online or social media sources

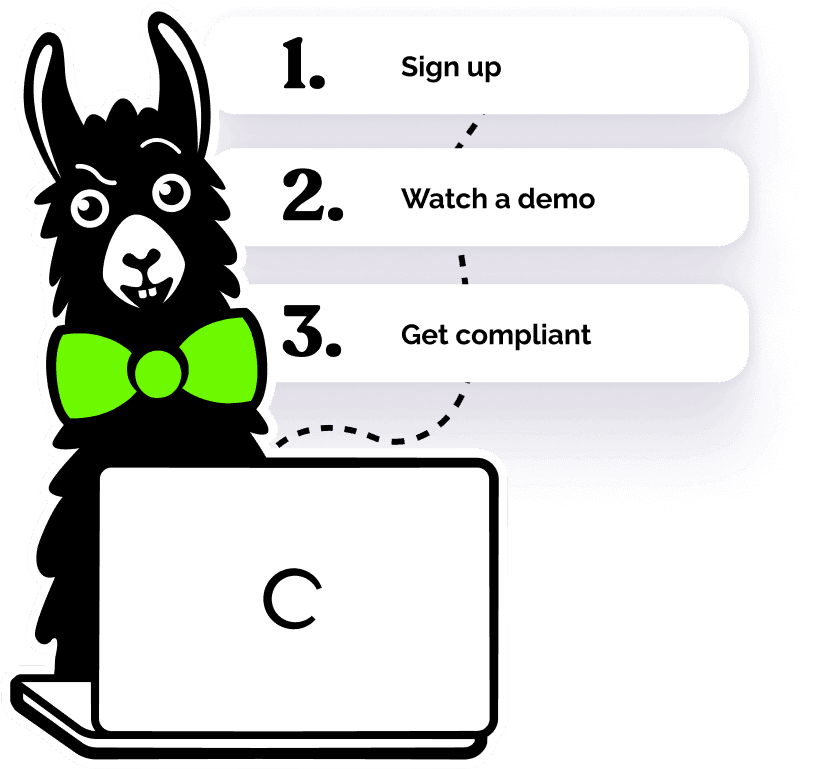

Avoid being a Tipper or Tippee with Insider Trading Training

Companies should provide guidance on the appropriate use of confidential information and provide resources to help employees identify potential insider trading situations. By providing Insider Trading training from EasyLlama, employees will have a better understanding of the rules and regulations that govern insider trading and be more likely to avoid any potential legal repercussions.

Helping over 8,000+ organizations create a safer, more inclusive company culture

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: