Avoiding Corruption when Working With Third Parties

Did you know that a company could be held criminally or civilly liable if a third party commits an act of bribery on the company's behalf, even if the company knew nothing about it? It’s important to keep yourself safe when working with third parties.

How to protect your company

You may not realize it, but when it comes to bribery, third parties can pose great risk to companies. Best practices for companies that work with third parties include fully vetting the third parties, requiring them to agree in writing to abide by anti-corruption laws, and paying attention to which existing third parties may pose the most risk.

Many Types of Third Parties

In business, a third party, also known as an intermediary, can be an individual or an entity that is not a primary party of the business, but one that helps facilitate some sort of business transaction. Examples can include mortgage brokers, employment agencies, collection agencies, payment processors, delivery services, logistics partners, vendors, independent contractors, and more.

Let’s review some concerns when dealing with third parties.

Predatory pricing happens when a supplier or service provider lowers a price to gain some type of competitive advantage. Competitive pricing in itself is not predatory, but it becomes predatory when the price advantage causes an issue with quality and or industry competition.

Reciprocal contracts act like a “tit for tat” agreement. For example, you buy my services and I make sure I purchase all of my goods from you, can be simply developing a relationship with a service provider or supplier, but when conducted unethically can cause dire situations for an organization and even an industry.

Exclusive contracts are contracts between two parties that prevent selling goods or services to others outside of the contract. This can have many benefits, such as ensuring a standard of goods and/or services, when they are ethical and legal. The concern happens when the exclusive contract makes it impossible for anyone else to compete within the industry. For example, the goods purchased may not be of the best quality or could be potentially dangerous to a consumer. This sense of obligation to reciprocate can cause situations where a person may not do their due diligence to ensure they are doing right by their organization and its consumers.

How common is Third Party Misconduct?

According to NAVEX Global, 90% of all FCPA enforcement actions over the last forty years have been linked to the misconduct of third parties. And a global fraud and risk report conducted by Koll in 2019 and 2020, found that of the global perpetrators of corruption and/or bribery, 27% were employees, while 22% were contractors.

Learn more about Third Parties

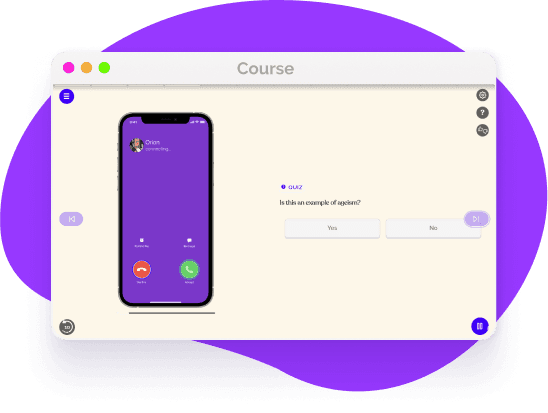

How does the FCPA address third party bribes and payments? Let’s find out:

Here are some myths to look out for:

- -

Under the FCPA it is unlawful to make a payment to a third party, while “knowing” that all or a portion of the payment will go directly or indirectly to a foreign official.

- -

The FCPA expressly prohibits corrupt payments made through third parties or intermediaries. The fact that a bribe is paid by a third party does not eliminate the potential for criminal or civil FCPA liability.

- -

Third parties and intermediaries themselves are also liable for FCPA violations.

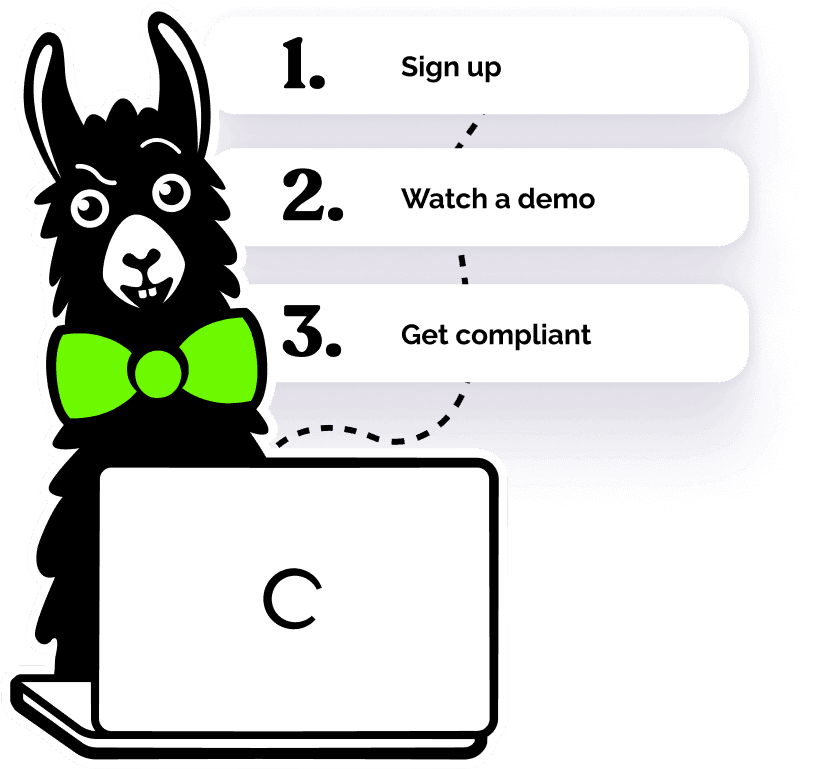

Protect yourself from Third Party corruption with workplace training

If a third party engages in bribery on a company's behalf, the corporation may be held accountable on both a criminal and civil level, even if the company was unaware. Working with third parties requires you to take precautions to protect the safety of your company. Understanding these nuances is made easier with employee training from EasyLlama, addressing bribes, corruption, third parties, and more.

Helping over 8,000+ organizations create a safer, more inclusive company culture

EasyLlama’s online training course guides learners understanding FCPA and other anti-bribery legislation. Organizations should prioritize minimizing corruption risks by implementing a comprehensive anti-corruption course. The course covers: