Wage Theft: Recognizing and Combating Unlawful Practices

Wage theft is a pressing concern in the realm of labor law. This illegal practice occurs when employers fail to pay their employees the wages they are rightfully owed. This can manifest in various forms, such as non-payment or underpayment of wages, violations of minimum wage laws, and illegal deductions. Addressing wage theft is not just a matter of money; it's about safeguarding workers' rights and upholding the dignity and value of every worker's contribution.

Understanding Wage Theft

When it comes to wage theft, it's essential to grasp its different forms. One common type is the non-payment or underpayment of wages, where employers either intentionally or unintentionally withhold a portion or the entirety of an employee's earnings. Minimum wage violations occur when an employer fails to adhere to legally mandated minimum wage rates. Overtime violations are another prevalent issue, often involving the misclassification of employees as exempt from overtime pay when they should be eligible for it. Furthermore, off-the-clock work is a practice seen in industries like retail and fast food, where employees are required to work without clocking in, denying them rightful compensation.

It’s also crucial to recognize that wage theft knows no bounds. It can be found across different industries, with low-wage sectors like agriculture, hospitality, and retail being particularly susceptible. In industries reliant on tips, wage theft can occur when employers unlawfully withhold or pocket employees' tips. The repercussions of these types of wage theft are profound for workers, leading to financial instability, difficulty in making ends meet, and elevated stress levels.

Recognizing Wage Theft

Recognizing wage theft is the first step toward combating it. Workers should be aware of the telltale signs and red flags that may indicate potential wage theft. These signs may include paycheck discrepancies, unpaid overtime, and instances where employees are asked to work off the clock. Importantly, employees possess legal rights and protections against wage theft. Labor laws, including the Fair Labor Standards Act (FLSA), set federal standards for minimum wage rates and overtime pay, ensuring that workers receive fair compensation for their labor. Additionally, it is vital for workers to promptly report instances of wage theft and maintain meticulous records of their work hours and wages.

Wage Theft Laws and Regulations

To combat wage theft effectively, it's crucial to have a comprehensive understanding of the relevant laws and regulations. The Fair Labor Standards Act (FLSA) and state labor laws play a significant role in addressing wage theft issues. Enforcement agencies, such as the U.S. Department of Labor, are responsible for ensuring compliance with wage and hour laws, and they offer valuable resources for workers affected by wage theft. Furthermore, legislative efforts continue to evolve to combat wage theft, with lawmakers advocating for increased penalties and stricter enforcement measures.

Empowering Workers to Address Wage Theft

Empowering workers is key to combating wage theft. To protect themselves against wage theft, employees must be well-versed in their rights under labor laws. Maintaining accurate records of work hours and wages is essential, as it can serve as vital evidence in wage theft claims. Additionally, seeking legal assistance when encountering wage theft and joining advocacy organizations can provide critical support and raise awareness about this issue.

Employer Responsibilities and Accountability

Employers bear significant responsibilities in preventing wage theft. They must familiarize themselves with wage and hour laws and implement fair pay practices. Creating transparent wage policies can prevent wage theft and ensure employees receive fair compensation. Employers who engage in wage theft can face legal consequences, including fines and penalties.

Strengthening Enforcement and Penalties

The effectiveness of efforts to combat wage theft can be enhanced through improved coordination between agencies and increased resources. Advocating for stronger penalties and increased accountability can serve as deterrents to employers engaging in wage theft. Collaborating with community organizations and labor unions can play a pivotal role in advocating for workers' rights and combating wage theft.

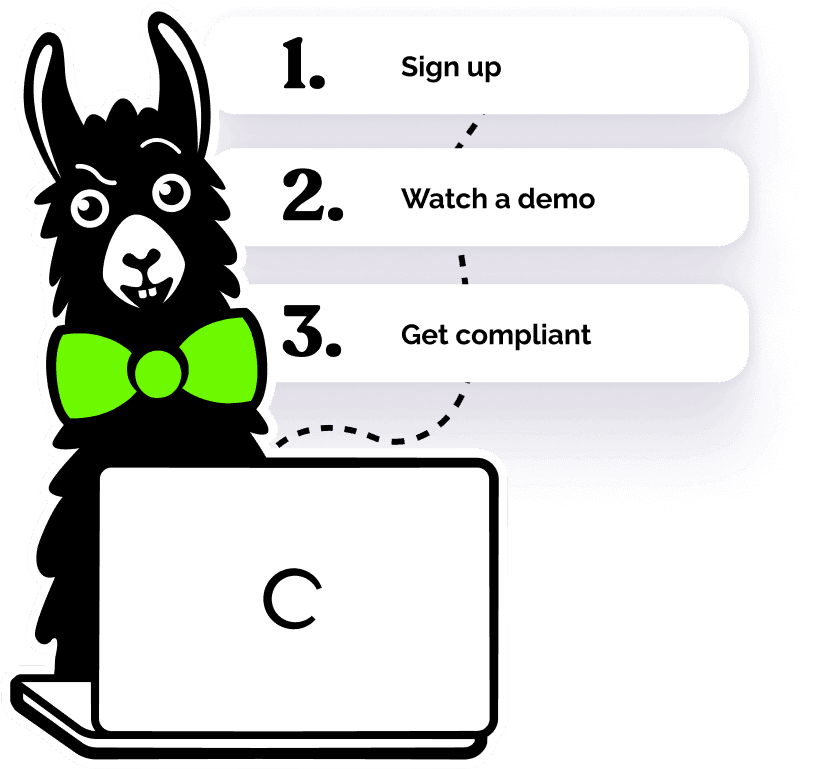

Recognizing, reporting, and combatting wage theft are essential steps in protecting workers' rights and ensuring fair compensation. Organizations can educate their supervisors and employees about best practices for labor laws with effective workplace training, such as EasyLlama’s Wage and Hour Course. This training provides employees with a better understanding of their rights as a worker while also outlining the responsibilities that employers must meet in order to remain compliant with the law. Our modern courses use engaging content, interactive quizzes, and real-life video scenarios to improve knowledge retention and, in turn, reduce employee turnover. Access your free course preview today to learn how we can combat these unlawful labor practices and create a more just work landscape for all.