What Is "Insider Trading" Charges In Business?

Despite insider trading being unlawful, people continue to gamble on it. Why, just last week, the well-known co-creator of "Sonic the Hedgehog" video game, Yuji Naka, was arrested in connection with the Square Enix insider trading investigation in Japan.

But what does "insider trading" mean, why is it illegal, and what, specifically are the charges one can be brought up on?

What Is Insider Trading?

Insider trading, in a nutshell, is the act of buying up or unloading company stock in massive amounts, owing to a decision made on the basis of "insider information" about that company not available to the public.

When it comes to a publicly traded company, all "material information" (i.e. relevant information that, if known, could affect investment decisions pertaining to this company) must be available publicly or not at all. The few "corporate insiders" that are privy to this information, should take great care to guard it.

Company "insiders" and the unauthorized persons they choose to share confidential information with can be found in several social categories:

- Current or former employees: obviously those who work at the company may have direct or indirect access to classified information that can influence people's decision to buy or sell company stocks.

- Lawyers, accountants, brokers, and other "constructive insiders": professionals who provide services for the company and handle its sensitive information may have unique opportunities to learn insider information crucial to the value of the company stocks.

- Friends and family members of corporate employees: those particularly close to corporate officers may be privy to some/all the corporate insider knowledge held by those individuals (sometimes by accident and sometimes by intentional "tipping off").

- Government employees: state/federal agencies workers sometimes get opportunities to obtain non-public information about publicly traded companies they have worked with or investigated.

- Politicians: members of the Senate and other politicians can know before anyone else in the country about impending wars, pandemics, foreign coups, and other events that can have a massive effect on the economy; the unscrupulous among them can use such information to invest heavily into, say medical or military companies, in anticipation of sudden profit gained from a disaster nobody else knows about yet.

Both -- the "insider" with access to material information as well as the person(s) being "tipped off" with such information -- can be brought up on illegal insider trading charges, if they had engaged in securities trading on the basis of that information.

What Is Insider Trading?

There is such thing as "legal insider trading": it is when corporate directors, shareholders, and other insiders trade their own company stocks -- as long that the security is registered with the US Securities and Exchange Commission and the trade is fully disclosed.

What makes illegal insider trading illegal is its lack of transparency.

What Makes Illegal Insider Trading Illegal?

Illegal insider trading occurs when any of the above-mentioned insiders use this corporate insider information to make predictions about whether the company's stock is about to soar or plummet -- and buy up or sell shares in anticipation of it.

As the result, insider trading creates unfair advantages for "insiders" within publicly traded enterprises, distorts the company's worth, and undermines the investors' faith.

Insider Trading Influences The Value Of Company Stocks

Suddenly unloading or bulking up on company stock can cause a chain reaction in the stock market. Others see this and take it as a "sign" of their own -- and follow suit in selling or buying their stock en masse. This, in turn, affects the company's equity securities' value on the stock market.

Insider Trading Is A Breach Of "Fiduciary Duty"

As medical professionals have a Hippocratic responsibility to do right by their patients, financial professionals too have a sacred duty to put their clients' financial interests above all else.

Given that insider trading is most often committed by company executives, insider trading betrays the interests of the company's investors in favor of the personal interests of those charged to protect them.

Being a loyal trustee of someone's money -- from being a stock broker to accountant -- is called "fiduciary duty" -- and its violation is equivalent to "treason" in the world of finance. Which is to say: it's punishable by law.

Charges For Violating Insider Trading Laws In The US

Let's consider the case of the above-mentioned Yuji Naka, the video game developer famous for having co-created the Sonic the Hedgehog franchise many years ago.

As mentioned, he was recently nabbed in Tokyo, along with two others, for insider trading violations pertaining to the Square Enix company. It is alleged that Naka, who had collaborated with Square Enix on an unrelated video game, and two other former employees of Square Enix, purchased large amounts of the company's shares right before the company publicly announced that it will be working on "Dragon Quest Tact", a mobile version of the popular Dragon Quest console game.

The allegation is that, with the benefit of this "material nonpublic information", the accused individuals assumed that the Square Enix company stock would go up significantly after the "Dragon Quest Tact" announcement. So, they bought up tens of thousands of shares, with the intention to sell them for big profit, when the prices shoot up.

This "scalper" technique used by insiders in the world of business is illegal in Japan -- and it's just as unlawful in the US.

Penalties For Insider Trading Violations

An insider trading violation can be punished with civil penalties, or involve criminal prosecution (or both).

In the US, the Insider Trading Laws are regulated by the Securities and Exchange Commission (SEC). SEC is also the agency -- along with the Federal Bureau of Investigation and sometimes the United States Postal Inspection Service -- to enforce insider trading laws by slapping offenders with fines and possibly seeking civil penalties. Criminal prosecution, if it comes to that, comes from the local US attorney's office and the Department of Justice.

Under the Securities Exchange Act of 1932 (amended by the 2002 Sarbanes-Oxley Act), a violator faces up to twenty years of imprisonment for criminal securities fraud, and a possible fine of up to five million USD for each willful violation. If the accused is able to demonstrate that the violation was not willful, only monetary penalties apply.

In terms of civil liability, an individual may have to forfeit/disgorge any profits gained/losses avoided through illegal trading -- as well as face civil penalties.

To avoid illegal insider inquiries from the government, companies ought to comply with the legal requirement to always report trading of company stocks by all their directors, company officers, and other members with access to confidential information to the US Securities and Exchange Commission.

Nip Illegal Insider Trading In The Bud At Your Company With Targeted Workforce Training!

In addition to satisfying insider trading rules set by the government, it is truly best for each company to take preventative measures of their own.

This which begins with educating the workforce to the pitfalls of illegal insider trading.

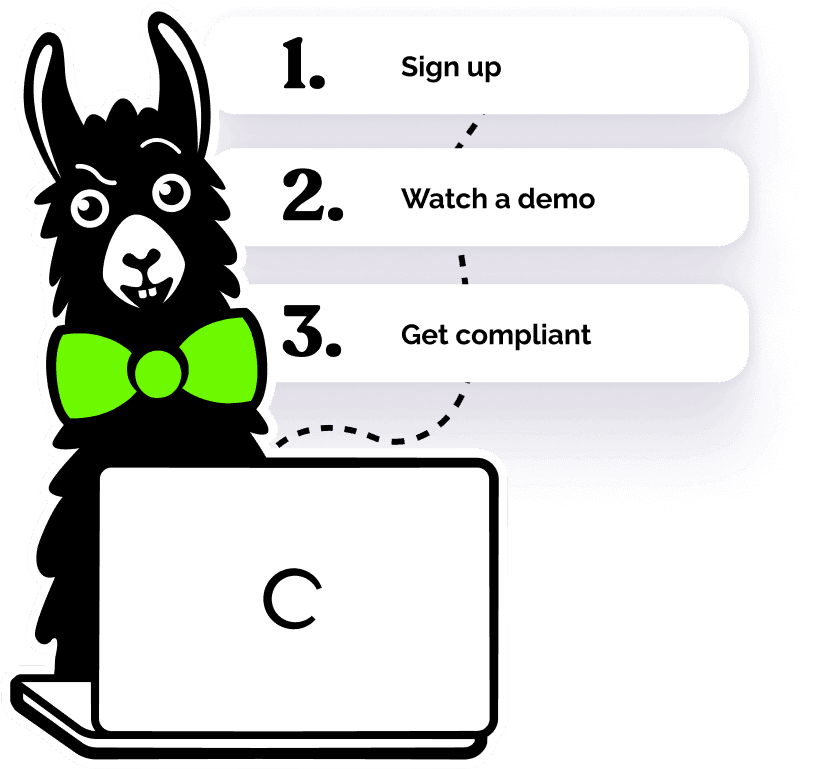

EasyLlama's Got The Anti-Insider Trading Training For You!

As the leader in the corporate compliance education space, EasyLlama offers a variety of workforce and leadership training programs that address topics of corrupt and sabotaging behavior at a company (from Workplace Violence to Anti-Bribery & Anti-Corruption).

Our new Anti-Illegal Insider Trading e-training program will bring your workforce up to speed on everything they need to know to stay away from illegal trading, from understanding the ethical and legal underpinnings of its consequences.

Sign up for a free preview today -- and feel the instant relief of knowing that your employees are getting the best compliance training on the market!

Written by: Maria Malyk