Criminal Money Laundering Techniques

Discover criminal money laundering techniques, learn common methods like layering and shell companies, and strengthen efforts to detect and prevent financial crime.

Reverse Money Laundering: Illicit Use of Legitimate Funds

Reverse money laundering is the opposite of typical money laundering. Typical money laundering attempts to disguise where dirty money is coming from, whereas reverse money laundering attempts to hide clean money that is used for illicit purposes. It disguises the funding of criminal activity through legally obtained money. This could include hiding the use of legitimate money to pay bribes, fund terrorism, or other illegal activities.

There are many techniques criminals use to launder money. Some of these include:

Integration is the reintroduction of laundered money into the economy as legitimate funds. Criminals can do this by investing in real estate, luxury goods, or other high-value assets or using funds to finance legitimate business activities.

Placement involves placing illicit funds into the financial system by depositing them into bank accounts, buying money orders or traveler's checks, or making other cash purchases.

Layering involves separating illicit funds from their illegal source by creating complex layers of financial transactions, making it difficult to trace the original source of the funds. This can involve moving money through multiple accounts or investments, using offshore shell companies, or buying and selling assets.

Trade-Based Money Laundering: Concealing Funds

Trade-based money laundering involves using trade transactions to move money across borders without detection. For example, criminals can over- or under-invoice goods or services or use false descriptions of goods or services to disguise the true nature of the transaction.

Additional Money Laundering Techniques

Explore additional money laundering techniques that go beyond the typical methods. Stay ahead of evolving financial crimes by exploring the intricacies of these additional money laundering techniques.

Here are some myths to look out for:

- -

Offshore Accounts: Illicit funds are transferred to jurisdictions with strict bank secrecy laws, making it challenging to trace their origins or beneficiaries.

- -

Virtual Currencies: Criminals exploit cryptocurrencies like Bitcoin to launder money due to the difficulty in tracing transactions.

- -

Hawala: An informal money transfer system used in many parts of the world. It involves transferring money through a network of trusted intermediaries without involving banks or other financial institutions.

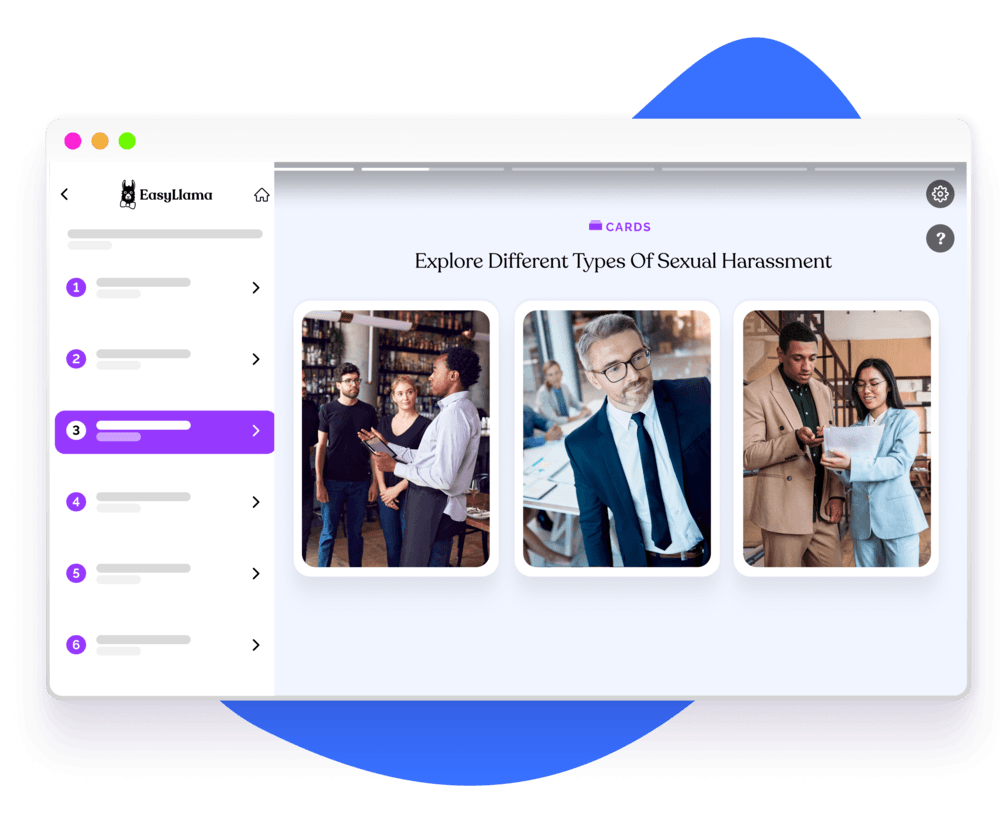

Recognize Criminal Money Laundering Techniques with EasyLlama

Recognize criminal money laundering techniques through training and enhance the ability to identify red flags and suspicious activities. Gain insights into common methods like layering, smurfing, and trade-based laundering to detect and report potential illicit financial activities effectively.

Helping over 8,000+ organizations create a safer, more inclusive company culture

Uncover the intricate world of anti-money laundering through our comprehensive course, delving into laws, criminal techniques, and effective prevention measures for enhanced financial security. This course covers: