Classifying Employee Relationships

Navigate the different types of employee relationships, how to properly classify them, and the implications for payroll, benefits, and other aspects of managing employees. It is important to understand the differences between these employee relationships in order to ensure compliance with wage and hour laws.

Importance of classifying employees accurately

Classifying employees accurately is important to ensure that employees are aware of the expectations and regulations that apply to their position. It is also important to ensure that their rights are respected and that they are provided with the necessary resources to be successful within their role. Additionally, accurately classifying employees can help to ensure that the organization is able to provide fair compensation and benefits.

There is no hard and fast rule for determining whether a worker should be classified as an employee or independent contractor, but in general, employees are entirely dependent upon the business they work for, while independent contractors are often self-employed and exercise a greater degree of control over their work. Next we will look at three guidelines that can be used for determining the classification of workers:

Independent contractors are able to work for multiple businesses at the same time, advertise services to other companies, and hire their own employees to help with work, whereas employees cannot.

If the employer has control over when and where the worker does their job, specifies a required set of hours and location, or specifies a certain set of tools that the worker must use to complete their work, they should likely be classified as an employee.

If the employer buys the worker's tools and equipment or pays for the worker's expenses, that worker should be classified as an employee, not as an independent contractor.

Misclassifying Workers

Misclassifying workers can lead to legal ramifications. If it's your job to classify workers, make sure you classify all employees and independent contractors correctly. Additionally, be sure to apply the correct classifications to exempt and nonexempt workers. Doing otherwise could lead to costly lawsuits, a loss in reputation, and make it difficult to attract talent.

Common Traits of Independent Contractors

Independent contractors are self-employed individuals who work on a freelance basis for companies or clients. Here are some traits that help separate them from employees:

Here are some myths to look out for:

- -

Set their own hours and work schedule

- -

Responsible for supplying their own tools and materials

- -

Receive payment on a per-project or per-hour basis

- -

Responsible for their own taxes and insurance

Understand employee rights with wage and hour training

Wage and hour training with employee rights is essential for any business to ensure that their employees are treated fairly and in accordance with the law. This type of training helps employers understand their legal obligations regarding minimum wage, overtime pay, meal and rest breaks, and other compensation and benefit issues.

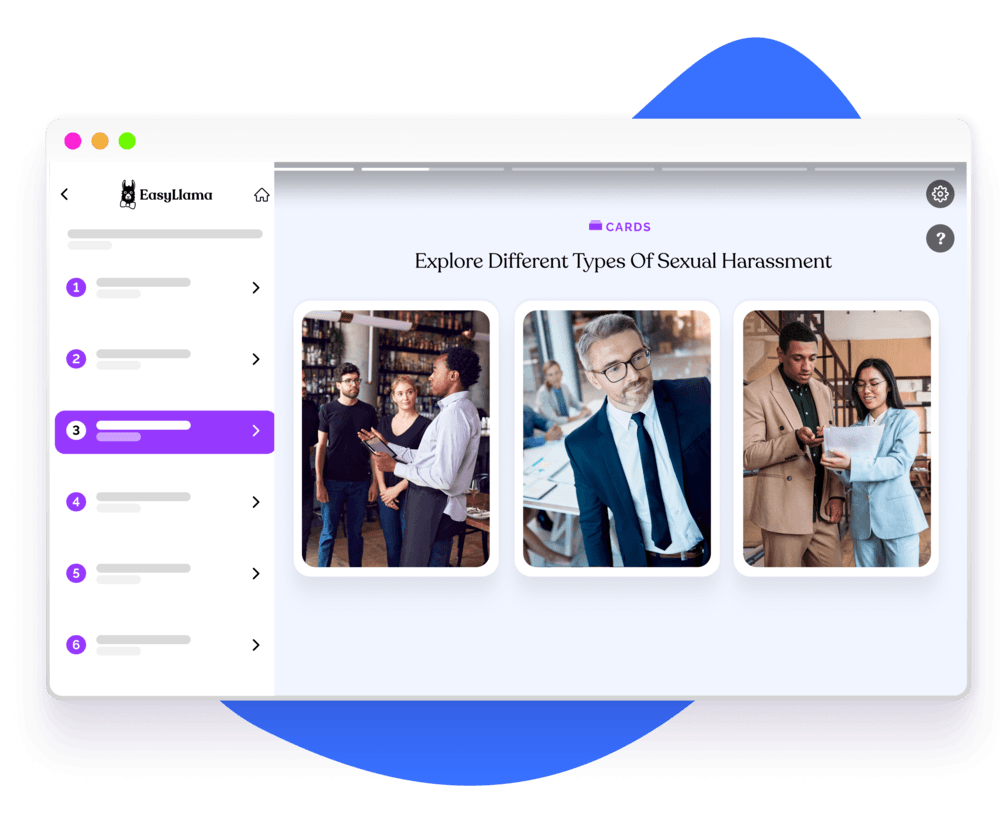

Helping over 8,000+ organizations create a safer, more inclusive company culture

EasyLlama’s online training course guides employers to understanding the rights employees have in the workplace. There are many wage and hour laws, and each one is designed to provide employees with safeguards from a potentially hostile work environment. The course covers: