Insider Trading Course Conclusion

With EasyLlama’s Insider Trading training, we hope employees gain a greater understanding of how to avoid illegal insider trading and how to stay clear of a potential SEC investigation. We can also review a few of the concepts that are covered in this course.

Keep Best Practices in mind when Investing

Understanding that illegal insider trading is a strictly regulated offense that the Securities and Exchange Commission, or SEC, takes seriously is vital. Everyone who trades securities on a public exchange may be subject to insider trading regulations, not just Wall Street bankers and staff members of publicly traded corporations. By following the law and putting some best practices into place, you can invest your hard-earned money in the same way you invest your time and energy.

All of the following choices would be considered Material Information that could affect the price of a company's stock.

When a publicly traded company experiences a change in leadership, it can have a significant effect on the company's stock price and its overall performance. If the change is positive, it can signal to investors that the company is in good hands and that the new leadership will bring fresh ideas, leading to an increase in the value of the stock. On the other hand, if the change is negative, it can lead to a decrease in the value of the stock, as investors may perceive it as a sign of uncertainty and potential risk.

Financial reports are statements that provide information about the financial performance and position of an entity, such as a business, government agency, or nonprofit organization. These reports typically include balance sheets, income statements, cash flow statements, and notes to the financial statements. Financial reports can be used to evaluate past performance, make predictions about future trends, and compare performance to similar entities.

Government approvals in trading include: 1. Licenses and permits: Depending on the type of trading activity, businesses may need to obtain licenses and permits from different government agencies. 2. Registration: Businesses may need to register with their local or state government in order to operate legally. 3. Inspections: Businesses may need to pass inspections in order to comply with safety and environmental regulations. 4. Tax compliance: Businesses may need to register for taxes and comply with filing requirements. 5. Anti-money laundering: Businesses may need to comply with anti-money laundering laws and regulations.

SEC Regulation

Which are types of securities that are regulated by the SEC? All of the securities listed are regulated by the SEC.

Here are some myths to look out for:

- -

Stocks

- -

Bonds

- -

Commodities

- -

Options

- -

ETFs and Mutual Funds

- -

Futures

- -

Cryptocurrency

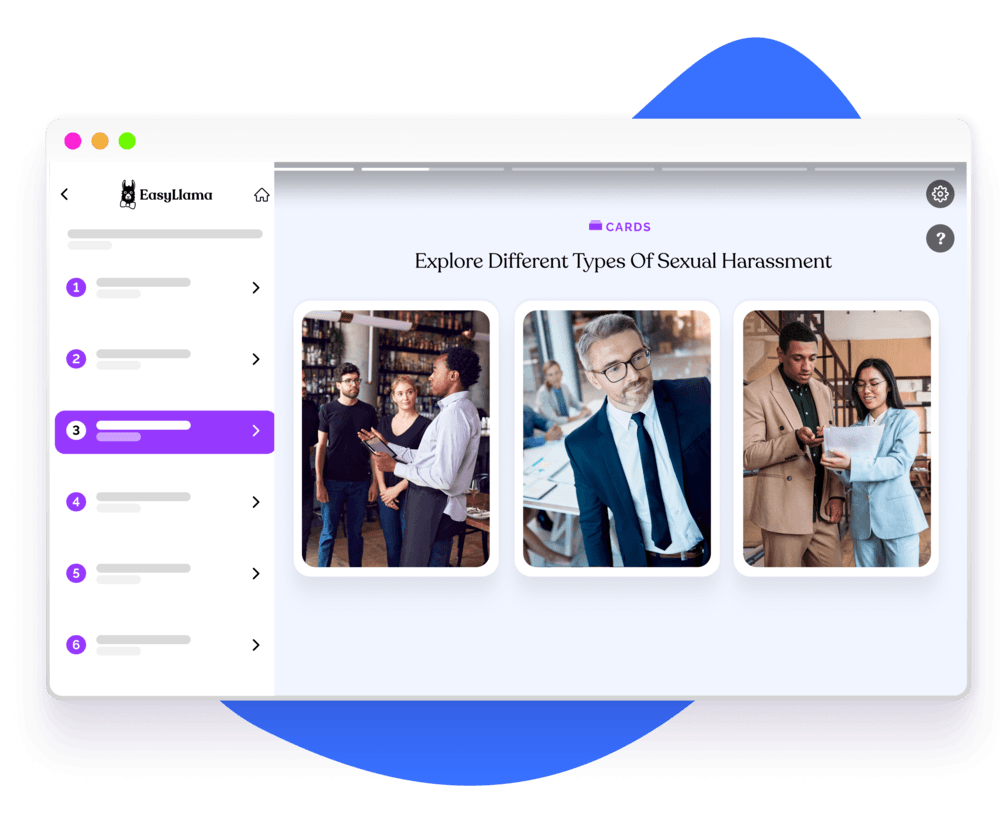

Invest in Insider Trading training to keep employees educated

The purpose of this course is to provide employees with knowledge about which trades are prohibited, strategies for avoiding prohibited trades, and procedures for conducting legitimate and moral trades in open markets. Your employees will gain valuable knowledge, skills and experience to support the strategic goals of your organization by examining actual instances of unlawful insider trading, and its repercussions, throughout the training.

Helping over 8,000+ organizations create a safer, more inclusive company culture

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: